Saving For Retirement Healthcare Costs – Doesn’t Medicare cover those?

According to Fidelity Investments’ 21st annual Retiree Health Care Cost Estimate, a 65-year-old couple retiring this year may expect to spend an average of $315,000 on healthcare and medical costs during retirement.

Even as many Americans try to turn the page on the events of the previous two years, keeping educated on projected future healthcare expenses should remain a key concern when saving for retirement.

HealthView Services’ research confirms this statement. Although six out of ten American employees are “significantly concerned” about their capacity to fund future healthcare costs, just 26% have calculated the monthly income needed to meet their retirement needs.

The company emphasized seven particular reasons why healthcare should be factored into retirement planning:

1. Because of healthcare inflation, expenditures will be higher at the end of retirement than at the start. In future dollars, the total lifetime healthcare expenditures for a healthy 65-year-old couple retiring this year are estimated to be $572,960. This covers Medicare Parts B and D premiums, supplementary and dental insurance, and out-of-pocket expenses for hospitalization, doctor visits, tests, prescription medicines, hearing treatments, hearing aids, vision, and dentistry.

2. Longer, healthier lives mean increased healthcare expenses in retirement. Like other areas of retirement planning, expected lifespan provides the best framework for estimating costs. Although yearly spending may be higher for seniors in poor health, lifetime expenses will be higher for healthier retirees on average because they’ll live longer. A 55-year-old woman with type 2 diabetes (expected to live to 80) will spend $3,470 more per year on medical costs than if she were healthy. However, because she’s likely to live a shorter life, her lifetime healthcare costs will be far lower than her healthy counterpart.

3. Health-related behavior changes can considerably impact longevity and healthcare expenses. According to RAND Corporation research, half of all individuals in the United States have chronic illnesses such as high blood pressure, type 2 diabetes, obesity, or high cholesterol. Many people in this group don’t follow their doctor’s treatment plans. In reality, almost half of all patients do not take their drugs as recommended.

Health issues — and how well they’re handled — are closely related to expected lifespan and retirement healthcare costs.

4. Health-related investing options can help to keep expenditures in check. Product selection, portfolio mix, and decumulation methods are crucial for long-term financial stability since they ensure that sufficient funds are accessible.

Choosing financial products that assist in lowering Medicare surcharges in retirement and utilizing tactics such as health savings accounts (for those enrolled in high-deductible plans) gives chances to optimize retirement income. Examples of such products include Roth 401(k)s, Roth IRAs, some life insurance and annuity products, and health savings accounts (HSAs).

5. Small contributions made while working can help minimize the burden of healthcare bills in retirement. As with other areas of retirement planning, modest regular payments to investment products, 401(k) plans, or health savings accounts build up. Generally, the more time investors have to reap the benefits of compounding returns, the better.

6. Meeting income replacement ratio (IRR) targets will cover part, but not all, of your future healthcare expenditures. Those on track to an IRR of 80% are already on their way to covering a share of future healthcare expenses. Current industry-standard IRRs presume that healthcare costs are the same between work and retirement.

7. One-time investments can help in managing retirement healthcare spending. Making additional weekly or biweekly payments may be the best choice for some to handle future healthcare needs. Others may prefer a one-time lump-sum investment to finance future costs, allowing them to take advantage of compounding gains.

Advisors play a critical role in helping clients take action by emphasizing possibilities to prepare for and control retirement healthcare spending, the HealthView research stated. Simply discussing techniques to manage — and even cut — healthcare expenditures in the context of the retirement planning process is a potent motivator of higher savings.

Contact Information:

Email: [email protected]

Phone: 8889193252

Popular posts

How to Deal with...

It's inevitable for prices...

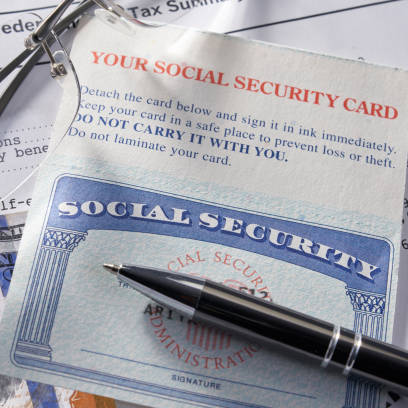

Maximizing Your Social Security...

Maximizing Your Social Security...

Free Retirement Benefits Analysis

Federal Retirement benefits are complex. Not having all of the right answers can cost you thousands of dollars a year in lost retirement income. Don’t risk going it alone. Request your complimentary benefit analysis today. Get more from your benefits.

I want more