Federal retirees received a 9% increase in COLA

The evaluation phase for January 2023 federal pensions and benefits is 75% complete. Considering a 1.6% rise in the impact of inflation used to calculate the COLA (cost-of-living adjustment) in June, the COLA count now stands at 9%.

The COLA is on track to surpass the 8.7% of 1982, and that was the highest payout since automatic yearly inflation adjustments for federal annuities started in the middle of the 1960s, barring a change in the direction of inflation, which has climbed every nine months of the count so far.

It would be paid in addition to the 5.9% paid to CSRS (Civil Service Retirement System) retirees at the beginning of the year and the 4.9% paid to FERS (Federal Employees Retirement System) retirees who are qualified for COLAs (usually not until age 62).

Every year on December 1, cost-of-living adjustments take effect and are allocated to the annuity payments made the following month. COLAs for retirees with a shorter retirement period are prorated based on the date of retirement. If you leave in January, the first adjustment, worth 11/12ths of the COLA amount, will be issued in January the next year. It’ll be 10/12ths if you resign in February, and so on. Upcoming COLAs will be paid out in full.

COLA, in Light of the Consumer Price Index

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI/W) average from the third quarter of one year to the next is the basis for the COLA. Earnings are frozen but just not lowered if the inflation estimate is negative in the end. Additionally, the COLA count’s beginning point stays the same in that case.

The identical formula applies to Social Security COLAs, except that a complete Social Security COLA is given to anyone who has received payments for less than a year.

Retirement Income and COLA

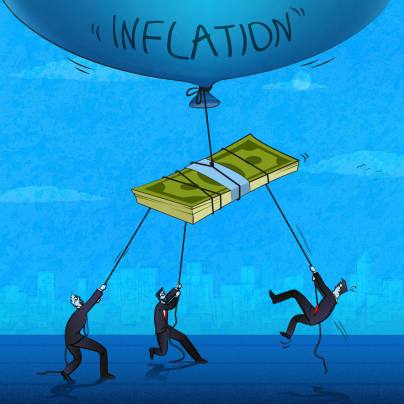

Inflation and rising prices for goods and services over time can significantly reduce investment income and the benefits of retirees living on a fixed income. If essential expenses such as food, housing, healthcare, and taxes rise, but monthly income stays relatively flat, seniors who had pleasant early retirements may eventually find themselves watching their pennies. This is a result of inflation eating away at their purchasing power.

Due to COLA, certain fixed retirement income programs go up with the cost of living. As long as the COLA formula is sufficiently generous, income from COLA-based annuities, COLA-indexed annuities, and government payments for seniors like Social Security will maintain its purchasing power as inflation rises.

Why Expect a Significant COLA?

The Social Security Administration bases its annual living adjustment on the CPI-W as an indicator of inflation. The 2022 Trustees Report for the Social Security program, published last week and predicting that the program would increase benefits by 3.8% at the end of 2022, is the source of Goss’ reference to a 3.8% COLA.

However, that prediction was made before inflation shot to its highest level in 40 years, and Russia’s invasion of Ukraine further drove up fuel and food prices.

According to Goss, the Trustees Report’s assumptions, particularly the economic ones, were established in mid-February of this year, before events like a war on the side of the world and the subsequent spike in inflation.

For beneficiaries who are now eligible for payments, a COLA of around 9% “is pretty great news since they will get a reasonably high rise in their benefits,” the speaker continued.

According to Social Security records, it would be the biggest COLA since 1981, while recipients received an increase of 11.2%.

Announcement

According to some experts, inflation will decline late this year even as the Federal Reserve keeps raising interest rates to stifle demand from businesses and consumers.

The agency made a COLA announcement in October, which was based on the inflation figures from the previous three months, so Goss’ prediction of 8% may not come to pass.

And there is a warning regarding receiving a significant benefit increase: A significant portion of the larger COLA might be offset by yearly increases in Medicare premiums.

For example, the Centers for Medicare and Medicaid Programs reported that the average cost of Medicare Part B increased by $21.60, or 14.5%, to $170.10 per month in early 2022. That higher price ate up a significant portion of the COLA boost for many seniors in 2022.

Contact Information:

Email: [email protected]

Phone: 9568933225

Bio:

Rick Viader is a Federal Retirement Consultant that uses proven strategies to help federal employees achieve their financial goals and make sure they receive all the benefits they worked so hard to achieve. In helping federal employees, Rick has seen the need to offer retirement plan coaching where Human Resources departments either could not or were not able to assist. For almost 14 years, Rick has specialized in using federal government benefits and retirement systems to maximize retirement incomes. His goals are to guide federal employees to achieve their financial goals while maximizing their retirement incomes.

Popular posts

TSP Contributions Are Changing—Here’s...

Key Takeaways The TSP...

FEHB Premium Hikes Have...

Key Takeaways FEHB premiums...

Free Retirement Benefits Analysis

Federal Retirement benefits are complex. Not having all of the right answers can cost you thousands of dollars a year in lost retirement income. Don’t risk going it alone. Request your complimentary benefit analysis today. Get more from your benefits.

I want more